Concerns have been raised about certain provisions in the draft Credit Union Bill, specifically regarding the proposed audit requirements and supervisory fees under the Reserve Bank of Fiji’s regulatory framework.

During a parliamentary Standing Committee meeting on the bill, union representatives questioned a clause that would allow the RBF to appoint an external auditor to re-examine financial records, even after a credit union has already completed its own audit.

They argued that this additional requirement could be both unnecessary and costly for their members.

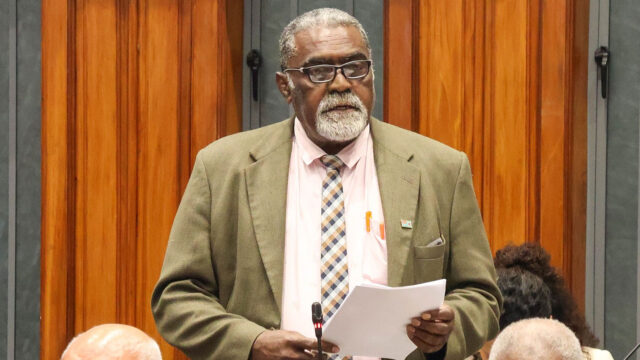

Member of the Standing Committee on Economic Affairs, Premila Kumar states that there is a need to strengthen the credit union space.

“The way credit union has been operating in Fiji for all this while is acceptable. But now we have to move a step up our game. You know, we have to go a step higher. And I think that’s what this bill is all about, rather than living in a comfort zone of giving small amounts whenever the members need.”

General Manager at Fiji Public Service Credit Union Emele Vakatora states that they aim to support their members better.

She states that the core purpose of their existence is to serve their members.

Vakatora says that they’d love to make profits where their members can thrive, but their functions is to provide welfare support and not necessarily to use resources to turn over huge profits

The General Manager of the Union says that they are hoping for a bill that accurately reflects the current environment.

“We are very much in support of revising or reviewing the legislation. We know it’s very outdated, and we would like a modern bill that reflects today’s environment, what our members need, and what the credit unions need to thrive”

Credit union representatives agreed on the need for modernisation and stronger legislation to support growth but maintained that the provisions on audits and fees need clear justification and consultation.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Nikhil Aiyush Kumar

Nikhil Aiyush Kumar