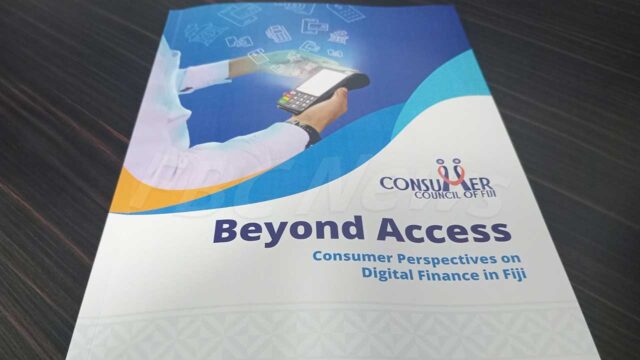

The Consumer Council of Fiji has discovered that while Digital Finance Service is convenient, it has its own challenges.

This has been revealed in the Council’s report on consumer perspectives on the Digital Finance Service in Fiji that was launched this morning.

Chief Executive Seema Shandil says 1, 140 people took part in the survey, and 72 percent of respondents use this service at least weekly and 28 percent on a daily basis.

Shandil says 51 percent of correspondents use mobile money wallets.

She says the insights gleaned from the survey are invaluable in guiding efforts to create a more inclusive, secure, and user-centric DFS ecosystem.

Shandil adds it is evident that while DFS adoption is on the rise, there remain significant hurdles that must be addressed to ensure the full benefits of digital finance are realized by all Fijians.

“Key findings from the survey reveal that while convenience and accessibility are driving factors behind DFS adoption, concerns regarding security, transaction disputes, and limited access persist among consumers.”

Shandil calls on stakeholders to collaborate to address these challenges effectively.

She says there is a need to enhance security measures, improve customer support responsiveness, and invest in digital literacy initiatives.

She adds that this way, consumers are empowered to navigate the digital landscape with confidence and ease.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Apenisa Waqairadovu

Apenisa Waqairadovu