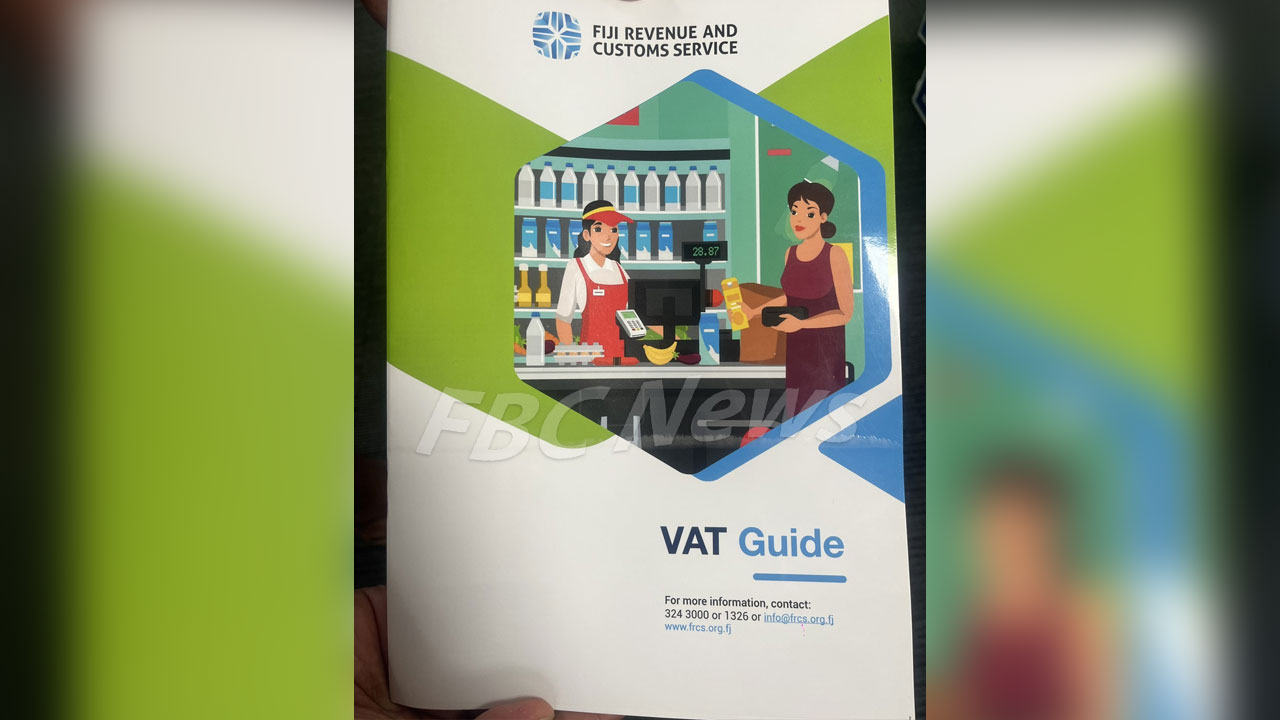

FRCS Vat Guide

There are still loopholes and non-compliance cases from registered VAT businesses, operators, and taxpayers when it comes to tax compliance strategies.

This was highlighted by the Fiji Revenue and Customs Service Acting Chief Executive, Malakai Naiyaga during the launch of the VAT Guide booklet and project this morning.

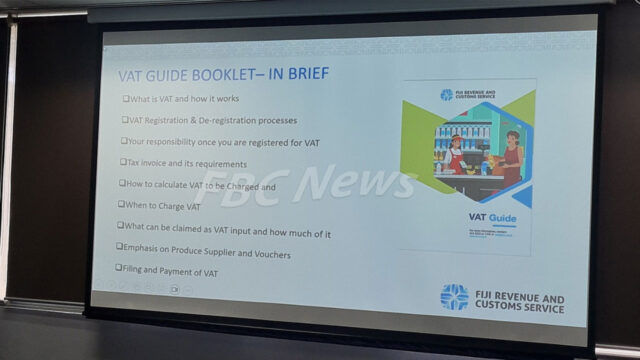

Naiyaga says that this is one of the core reasons for the introduction of the booklet and content, which will assist in creating awareness about tax payments for businesses and the VAT legislation compliance project more effectively.

“One of the things that we have identified is that VAT is the largest component of the government revenue that FRCS collects. It is equally a large risk area in terms of non-compliance. Now, given that we are moving to self-assessment, it is important that tax payers are fully aware of their obligations under the VAT regulations.”

Principal Auditor Seleti Tawaketini adds that another drive for the VAT Guide is to ensure the cost of compliances is reduced by ensuring that the role of the person or businesses that are registered under the VAT is documented in a possible way that is understandable and accessible.

The Vat Guide is available on the FRCS website for the public to access.

Peceli Naviticoko

Peceli Naviticoko