[Photo: Supplied]

The Fiji Revenue and Customs Service, in collaboration with the Fijian Competition and Consumer Commission, has intensified inspections and is closely monitoring the market.

This is to ensure that the changes in the value-added tax rates and customs duties announced in the 2023–2024 National Budget are reflected correctly in the final prices and that consumer interests are protected.

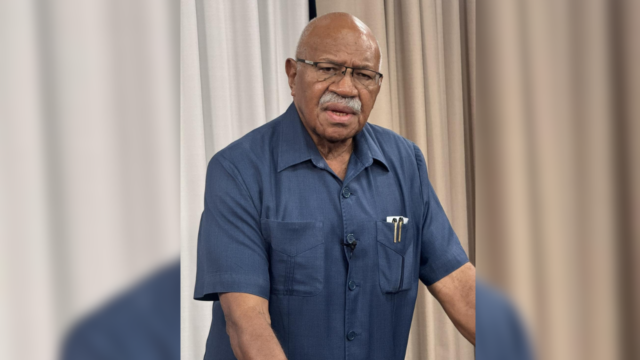

FRCS Chief of Staff Shavindra Nath says the FRCS team has also been conducting an analysis of shipping and other related costs to verify the pattern of price changes.

Nath says it is important to ensure that the intentions of the budget policies announced by the government is achieved.

He adds that when taxes or duties are reduced, the intent is to reduce the prices of the products and promote consumer choices.

Nath says if the prices are not reduced, then it defeats the purpose of the changes.

Therefore, he adds, it is critical for agencies such as FRCS and FCCC to monitor that the changes are correctly reflected in the prices.

Since Tuesday, the three VAT rates have been replaced with a simplified two-rate system.

The nine percent VAT rate has increased to 15%, while the zero percent VAT rate has been maintained.

The 21 zero-rated VAT items have been increased to 22 items with the addition of prescribed medicine.

Additionally, import duties have been reduced on sheep and lamb meat, prawns, ducks, corned meat of lamb, sheep, and beef, canned mackerel, canned tomatoes, and chicken portions.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Kreetika Kumar

Kreetika Kumar