[File Photo]

The Fiscal Review Committee has released its report, entailing a number of recommendations they have made to the government, including a submission to increase tax and VAT in a number of areas.

Finance Minister Professor Biman Prasad confirms receiving the report, saying it has set out the significant fiscal challenges the government faces and some possible solutions.

The committee has recommended that corporate tax be increased to 25 percent with some relief for corporate SMEs, increased VAT to between 12.5 percent and 15 percent with no zero-rating on essential items, increases in departure tax to return to $200 per passenger by 2025, and increased customs revenue, particularly on liquor.

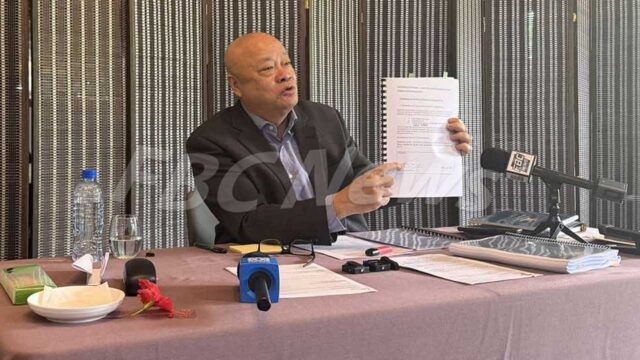

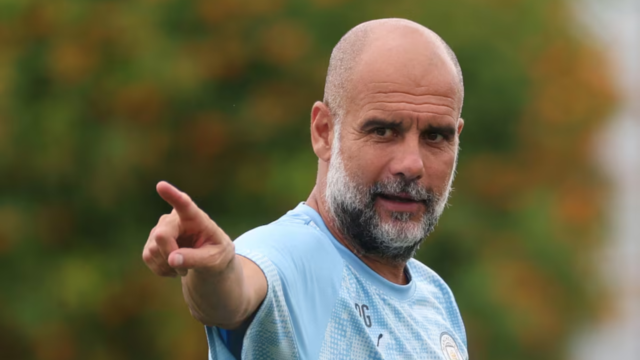

Finance Minister, Professor Biman Prasad.

The report says these can be balanced by new expenditure measures, including increased social welfare spending, targeted direct assistance to lower-income households, and increased capital expenditure on infrastructure and health.

It says that government is, and has been for some time, seriously underfunded, adding that we cannot expect better services from government unless we are prepared to shoulder, through taxation, the monetary burden that is needed for those services and to better manage the government debt that has accumulated in the last decade.

The committee says new revenue is needed to fund not just urgently needed infrastructure but also more effective administration and additional recurrent spending on health.

It adds that it is also needed to stabilize and begin to reduce the government’s oversized public debt. In the simplest terms, the Committee thinks that the government must collect an additional net amount of at least $500 million each year.

Aerial shot of Suva City.

This is after compensating measures for low-income households as necessary.

The committee says this sets the government on a more certain path for stronger economic growth, lower debt, and better infrastructure investment.

It says more revenue—that is, more than the $500 million they are proposing—would improve that path, but they also appreciate that there are limits to the amount of additional tax that the people and businesses can bear.

The Finance says his Ministry has had the benefit of reviewing the Report and its recommendations in draft and has been considering some of them as part of the National Budget process.

Prasad says a number of the committee’s recommendations are for long-term changes rather than immediate budget priorities.

He says these will be taken up by the Department of National Development and Strategic Planning.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Apenisa Waqairadovu

Apenisa Waqairadovu