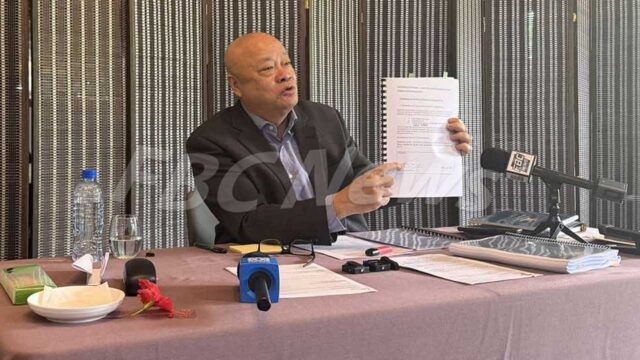

A Working Committee Group will be carrying out consultations on the access to capital bill, which intends to implement and regulate new financing alternatives for raising capital or funds.

Minister for Trade Manoa Kamikamica says access to finance for Micro Small and Medium Enterprises has undoubtedly been a challenge, and despite incentives offered by the government, the issue persists.

Kamikamica says that in Fiji, it is estimated that the financing gap for MSMEs is around $2.2 billion.

Manoa Kamikamica says this is an initiative that will shape the future and development of MSMEs in Fiji.

“In December last year, the Cabinet endorsed the need for new legislation to introduce, implement, and regulate new financing alternatives for MSMEs. Discussions and industry consultations on the draft legislation are to be carried out by the Working Group.”

Kamikamica says that through the bill, new forms of raising capital will be introduced in a regulated manner, like small offers, equity crowdfunding, and peer-to-peer lending.

Permanent Secretary Shaheen Ali says the bill provides a lot of options for financing for MSMEs.

The Ministry has spent more than $100 million in grants for MSME development.

Kamikamica believes that this initiative would also ease pressure on public finances, which can be prioritized in other areas of national development.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Apenisa Waqairadovu

Apenisa Waqairadovu