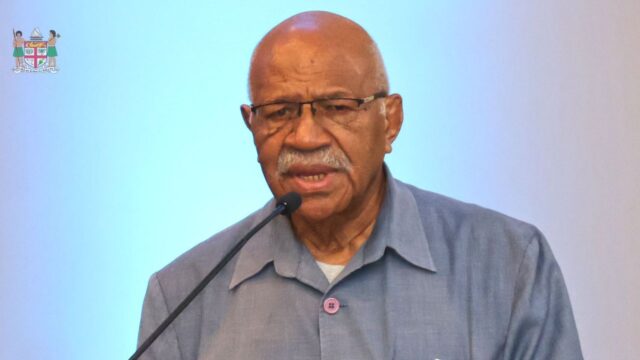

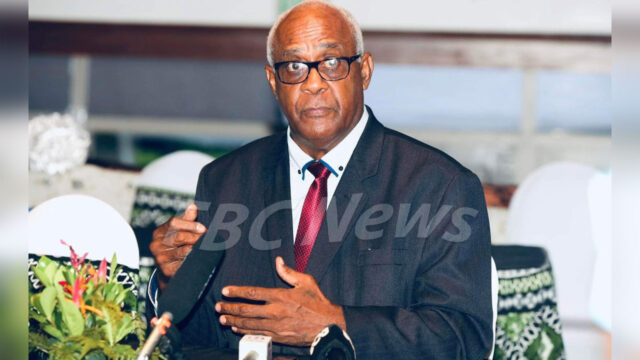

Source: [file photo]

The Fiji Revenue and Customs Service has identified several sectors with ongoing non-compliance issues.

Speaking at the launch of the 2025–2028 Compliance Improvement Strategy, FRCS Manager for Risk Assessment and Financial Intelligence, Rohitesh Dass, named the agriculture, wholesale, retail, tourism, and non-profit sectors as those requiring specific attention.

Dass says that FRCS is adopting tailored approaches for each sector, as they all have different compliance obligations to fulfill.

He adds that the tax compliance challenges in the agriculture sector stem from widespread informal operations, fragmented supply chains, under-declaration of income, and the misuse of tax concessions.

“To address these concerns, FCRC is focusing its efforts on key agricultural cash supply chains including tobacco, taro, cassava, ginger, kava, dairy and poultry. The objective is to enhance transparency, strengthen reporting mechanisms and ensure equitable tax contributions across the entire sector.”

Das says that the wholesale and retail sector poses a high risk for tax non-compliance, particularly with VAT reporting and cash-based transactions.

While tourism remains a key economic growth driver, businesses in this sector also have compliance issues.

In this sector the FRC has identified compliance risks such as under reporting of income, cash-based transactions and incorrect VAT claims.

The FRCS has also seen non-compliance among small service providers, specifically in the arts, entertainment, and non-profit sectors, including content creators, photographers, and performers.

The FRCS says many non-profit organizations are also reportedly unaware that income from business and property is now taxable under recent changes to the Income Tax Act.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap