Self-employed Fijians and younger women are of the strongest belief that digital financial services pose a risk to their cohort group compared to younger men.

This is based on a report released by the United Nations Capital Development Fund, which conducted a Digital and Financial Literacy baseline survey in seven Pacific Island countries, including Fiji.

The Dissemination Workshop of the Digital and Financial Literacy Report in Fiji was released yesterday.

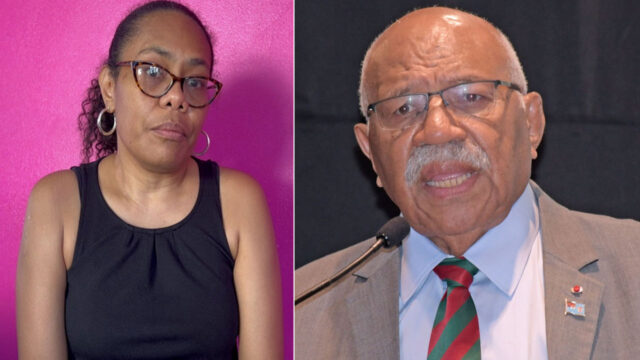

UNCDF Regional Digital Manager Neha Mehta believes that there is a need to create an inclusive digital economy without leaving anyone behind.

“It’s not just to make sure people are able to use mobile devices in a more cohesive manner, but it’s also the way to make sure that we bring everyone together, whether it’s about e-governance, whether it’s about making sure that we enable cashless payment, or whether it’s about doing immigration facilities online.”

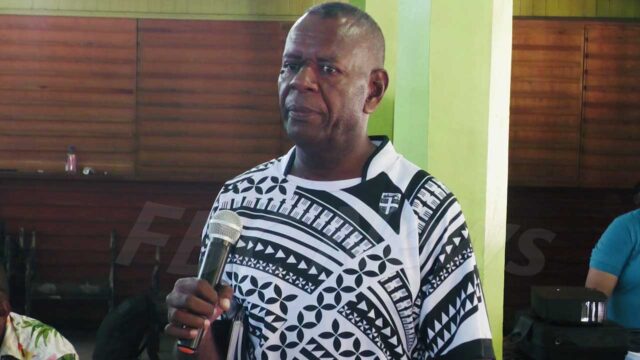

Reserve Bank of Fiji Acting Chief Manager Economics, Caroline Waqabaca says the report raises challenges that warrant targeted interventions.

“Our new national financial inclusion strategy, which guides our action to address existing gaps, identifies four pillars, one of which is consumer protection and financial capability, and under this pillar we aim to ensure all Fijians have access to high quality financial education.”

The report also states that while access to financial products and digital financial services is high in Fiji, their regular use in terms of day-to-day transactions is still limited.

Praneeta Prakash

Praneeta Prakash