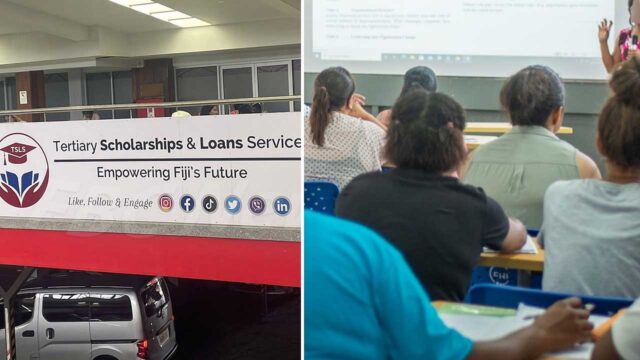

The Housing Authority of Fiji is working closely with the iTaukei Lands Trust Board to recover the $2.5 million allocated for the Village Housing Loan Scheme.

In response to inquiries from the Public Accounts Committee, Chief Executive Ritesh Singh explained that since the method of land rental distribution was altered, repayments for this loan scheme ceased.

Housing Authority was working with the TLTB on this scheme.

“And unfortunately, the only way of recovering the $2.5 million is to work with TLTB and with the respective land owning units to recover that money. So that $2.5 million, we are working separately.”

Singh explains that TLTB has an interest in this project and they are hoping to resolve it in the next couple of months.

“We have had some good discussions and we’re making progress. We will revisit all these landowning units again, because there’s demand for it. We have got our product ready again. We want to launch this product back to the market because there’s so much demand. Because housing is supposed to not only be developing the urban and peri-urban areas, but we want to go down to the rural areas also, because we’ve got the products. Unfortunately, until we resolve this, we can’t re-launch the product.”

Singh explains that they have another six million dollars’ worth of non-performing loans.

He adds that the Housing Authority has been working with customers to convert these into performing loans, with the last resort being to put these properties up for mortgage sale to recover the funds

“We’ve also, for the upcoming budget, we have made a submission to the government, if the government could also support the very low end of the market, those that have paid two times more of their loan and still their loan is outstanding, some sort of funding or grant to be given to them so that we don’t have to take that hard action of evicting them or putting the properties on mortgage sale.”

The Housing Authority’s non-performing loan stands at eight million dollars, with a target of reducing it to five percent, in line with industry standards.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap