The Fiji Revenue & Customs Service say that the move from EU to add Fiji to the blacklist of tax havens is largely symbolic, having virtually no impact on the minimal EU trade and investment in the country.

In a statement, FRCS Chief Executive Visvanath Das claims EU’s decision was based on the incentive package that Fiji uses to attract and cultivate new business, such as moving headquarters to Fiji, thereby urging domestic economic activity and job creation.

Das says Fiji stands by its business incentive package, one that has contributed to the nation’s unprecedented nine years of economic growth.

He claims the EU did not carry out an effective analysis on the impact that the removal of these tax incentives would have on the Fijian economy, despite requests from FRCS.

Das adds without an impact assessment, the haphazard removal of standing tax policies would have been hugely irresponsible.

The CEO says they voiced these concerns to the EU, noting the economically-destructive impact that removing tax incentives would have, including the loss of thousands of Fijian jobs, to no avail.

Das adds the nation’s tax policies which are in line with international standards do not create any tax avoidance opportunities that would allow EU businesses to artificially shift their profits to Fiji to minimize tax.

He mentions that Fiji has demonstrated that these incentives create real economic activity and has a direct impact on the nation’s macro-economic stability.

Das says the EU’s decision was both ill-informed and out-of-touch with the needs of a developing economy.

International organizations, such as the International Monetary Fund (IMF), have spoken highly of Fiji’s tax reforms during their various missions to Fiji, and have used Fiji as a model country for responsible and innovative economic policy in the region.

Meanwhile, the 28-nation EU set up the blacklist in December 2017 after revelations of widespread tax avoidance schemes used by corporations and wealthy individuals to lower their tax bills.

EU finance ministers added 10 jurisdictions to the updated list.

They are the Dutch Caribbean island of Aruba, Barbados, Belize, the British overseas territory of Bermuda, Fiji, the Marshall Islands, Oman, the United Arab Emirates, Vanuatu, and Dominica.

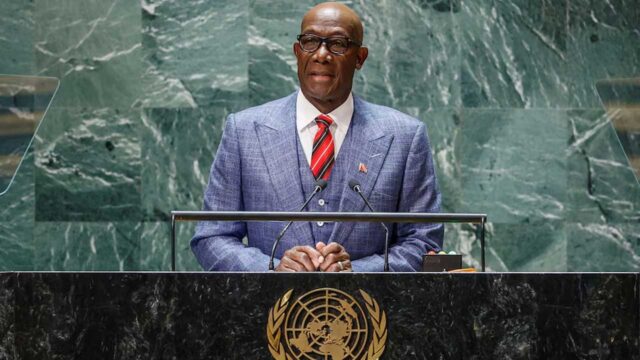

They join Samoa, Trinidad and Tobago, and three U.S. territories of American Samoa, Guam, and the U.S. Virgin Islands who were already on the blacklist.

Blacklisted states face reputational damages and stricter controls on transactions with the EU, although no sanctions have yet been agreed by EU states.

Ana Ravulo

Ana Ravulo