Ariel shot of Suva City. [File Photo]

Fiji’s current debt to GDP ratio is at an alarming 80%, which means Fiji is spending more on debt service shelving essential expenses.

The Reserve Bank of Fiji states the debt level increased over the past four years due to a 22% GDP contraction due to the COVID-19 pandemic.

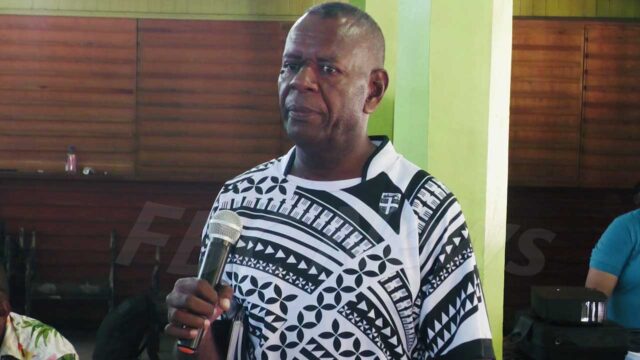

Former RBF Governor, Savenaca Narube says this is a risky trend, and based on his debt-servicing calculations, 44 cents of each dollar of domestic revenue goes into debt repayment.

“We know it (debt) is the highest yet in history. But nobody talks about debt servicing too much; what is debt servicing? Is crowding out essential expenses of government?”

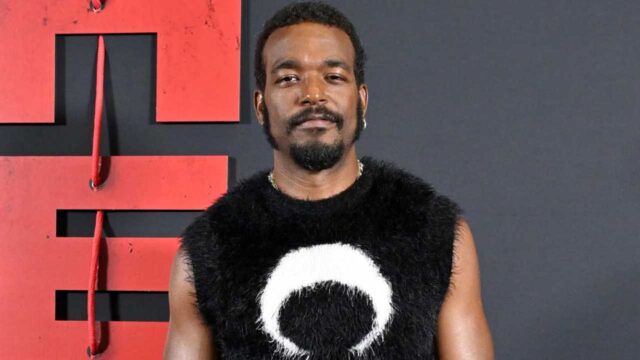

The Reserve Bank of Fiji’s Governor, Arif Ali, says Fiji is walking on thin ice with the current debt-to-GDP ratio.

“Given that our debt level is relatively high, in the event that we have another catastrophe then the room to borrow will not be there. So we all agree that the trend in our debt level should be downwards.”

Ali says the focus should be on ensuring the economy grows in order to keep debt at a manageable level.

This means increasing interest to a neutral level, which is 3% higher from its current standing.

Kirisitiana Uluwai

Kirisitiana Uluwai