[Photo: Supplied]

HFC Bank’s partnership with DT Global New Zealand Limited under the auspices of Business Link Pacific (“BLP”) being New Zealand

Government’s MFAT-sponsored Pacific SME Finance Facility is creating a profound impact on the Bank’s SME portfolio.

The facility is a bilateral agreement between HFC Bank and BLP and is a joint private-partnership initiative in establishing concessional loans initially availed between $20,000 and $50,000 to eligible SME borrowers.

The maximum funding limit was recently increased to $120,000 in recognition of the growing success of this innovative and unique

facility.

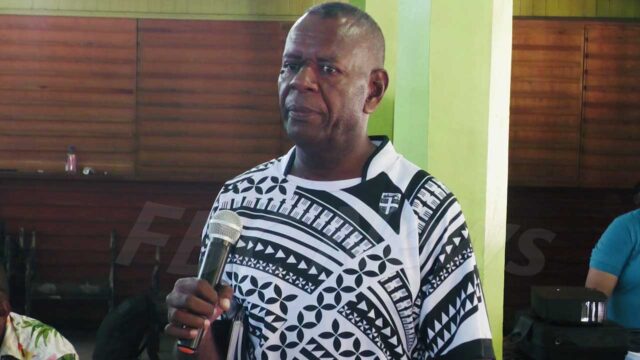

HFC Bank CEO, Rakesh Ram, is grateful to BLP for their commitment and assistance in partnering with HFC Bank, the only local bank, as a

conduit in reaching out to the small and medium business operators which do not generally have readily available finance to realise their

dreams.

“Being Fiji’s own Bank, we at HFC Bank are committed to provide convenient and innovative banking services that contributes towards

the betterment of Fijian people.

HFC Bank is always looking for ways to improve its service offerings and we aim to be Fiji’s Bank of choice by reaching out and ensuring that we can always be there for our customers”.

The product is relatively similar to funding provided through Government of Fiji via RBF; however, this initiative is a private sector

approach aimed in supporting government’s drive and strategies to grow the SME segment.

“As the Fijian Bank, HFC Bank aligns it’s strategies towards the development and growth of the local economy and will collaborate

with both the government and private sector to foster economic wealth for our people.

This is the second such initiative during the recent months and I am pleased that HFC Bank is also the major investor in the Blue Bonds to support the climate initiatives” Ram concluded.

Eligible SME borrowers may apply for concessional loans for various purposes such as working capital requirements, trade financing,

business asset acquisitions and investments.

To further enhance the accessibility of this facility to a broader spectrum of the SME segment, the partnership is leveraging off the

expertise of Business Assistance Fiji (BAF) in collating, compiling, and preparing business cash flow forecasts, financial statements, business

plans and business proposals for eligible applicants, at no cost.

This integrated approach in providing innovative financial solutions epitomize HFC Bank & BLP’s confidence in supporting SME’s.

HFC Bank is cognizant of the unique challenges faced by SMEs and encourages SME operators to take advantage of this facility.

Mrs. Mereani Bruce, a recipient of the facility who operates her own pharmaceutical business in Navua, Sure Care Pharmacy, stated “I

recently had an opportunity to work with HFC Bank for a SME loan and my experience was exceptional as I was offered a HFC-BLP SME

approved loan.

From the initial application process to the final disbursement of funds, this facility demonstrated professionalism, efficiency, and a customer-centric approach making the application a seamless process.

I felt supported and confident in their abilities to meet my business needs.

This loan will allow me to implement long-term growth strategies.

I will be able to expand my product line, enter new markets, solidify partnerships with key suppliers and position my company for

sustained success. Vinaka vakalevu HFC-BLP for supporting SMEs in Fiji.”

“As the Fijian Bank, HFC Bank aligns it’s strategies towards the development and growth of the local economy and will collaborate

with both the government and private sector to foster economic wealth for our people.

This is the second such initiative during the recent months and I am pleased that HFC Bank is also the major investor in the Blue Bonds to support the climate initiatives” Ram concluded.

Eligible SME borrowers may apply for concessional loans for various purposes such as working capital requirements, trade financing,

business asset acquisitions and investments.

To further enhance the accessibility of this facility to a broader spectrum of the SME segment, the partnership is leveraging off the

expertise of Business Assistance Fiji (BAF) in collating, compiling, and preparing business cash flow forecasts, financial statements, business

plans and business proposals for eligible applicants, at no cost.

This integrated approach in providing innovative financial solutions epitomize HFC Bank & BLP’s confidence in supporting SME’s.

HFC Bank is cognizant of the unique challenges faced by SMEs and encourages SME operators to take advantage of this facility.

Mrs. Mereani Bruce, a recipient of the facility who operates her own pharmaceutical business in Navua, Sure Care Pharmacy, stated “I

recently had an opportunity to work with HFC Bank for a SME loan and my experience was exceptional as I was offered a HFC-BLP SME

approved loan.

From the initial application process to the final disbursement of funds, this facility demonstrated professionalism, efficiency, and a customer-centric approach making the application a seamless process.

I felt supported and confident in their abilities to meet my business needs.

This loan will allow me to implement long-term growth strategies.

I will be able to expand my product line, enter new markets, solidify partnerships with key suppliers and position my company for

sustained success. Vinaka vakalevu HFC-BLP for supporting SMEs in Fiji.”