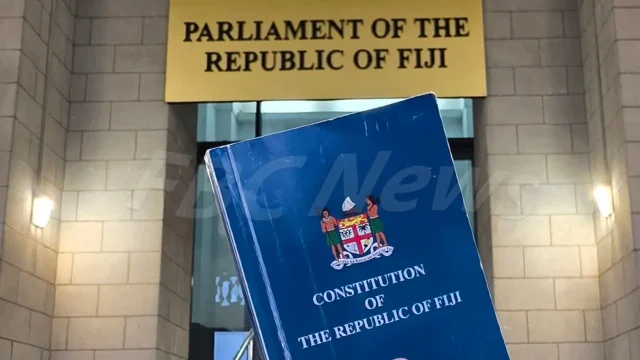

The Asian Development Bank in its latest report has stated that given that not all economic sectors in Fiji have returned to pre-pandemic performance, raising revenue from corporates may be concentrated on a few sectors such as tourism.

It says while raising indirect taxes such as VAT may boost government revenues, consideration must be given to those in the middle-income group.

The ADB says only 20,000 workers in Fiji are paying income taxes, with the threshold set at F$30,000 a year.

The ADB says that according to the ILO, around two percent of Fijians are earning below $1.90/day in purchasing power parity or are extremely poor.

The proportion increases to 16% for the moderately poor earning between $1.90 and $3.20 a day, while around 39% are considered near poor earning between $3.20 and $5.50 a day.

The ADB says Fiji’s national minimum wage rate is set at $3.01/hour from April 2022 and was set to increase in stages up to $4.00/hour by January 2023.

Those in this income category according to ADB may not necessarily be covered under social welfare support and may need to pay more for items outside of the 22 VAT zero-rated list.

It adds the economic recovery is supported by the strong rebound in the tourism industry.

While risks are tilted to the downside with the slowdown in major tourist source markets, fiscal consolidation is necessary to support public investment in key areas such as health, education, and water.

The ADB stresses that new revenue measures are critical but need to be balanced out with a strong social protection system to ensure that the most vulnerable people are protected and that the tourism price competitive edge is somewhat protected.

It says with 24.1% of Fijians living below the poverty line pre-pandemic, raising taxes at a time when the economy has not fully recovered or income levels restored needs to be carefully monitored.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap