ANZ Pacific Economist Kishti Sen states that the 2025-26 National Budget contributes by offering policy and legislative certainty.

In his view, this certainty is the most critical ingredient for building and maintaining confidence in the private sector, both locally and internationally, to continue investing in Fiji.

Sen says as long as this continues and the economic blueprint is executed well, Fiji’s debt-to-GDP ratio will continue to come down, future budgets will have smaller deficits, and there is a real chance of achieving surplus budgets and starting to pay down debt within the next 10 years.

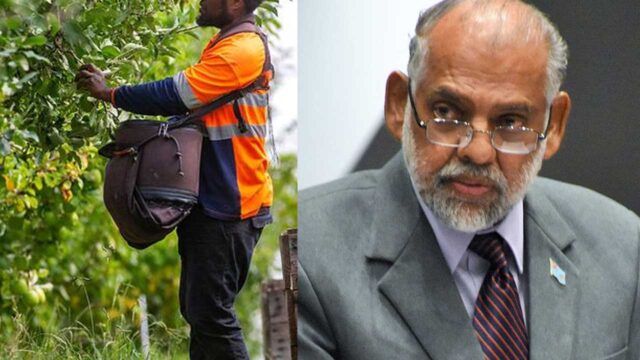

The Deputy Prime Minister and Minister for Finance, Professor Biman Prasad, yesterday announced a $4.8 billion money plan for the 2025-26 fiscal year.

According to Sen, this is the largest fiscal expenditure program in Fiji’s history, and it will be paid for through organic growth in revenue (that is, as the economy grows, $3.9 billion, also a record for Fiji) and borrowings of $0.9 billion.

But he says for the here and now, the government is keeping spending up, and that’s a good outcome.

Sen adds the Fijian economy is transitioning from being a tourism-led economy to a more balanced economy in the future. As a result, growth has slowed.

He states public demand, both recurrent and capital, makes up 25% of GDP, and the strength of government stimulus is needed now to sustain and support the economic transition and overall economic growth.

Sen states that official forecasts have consumer prices rising by 1.1% this year. However, he doesn’t believe these forecasts have factored in the reduction in VAT and import duties on consumer products announced in the Budget.

Sen says with oil prices expected to head lower due to slower global GDP growth and as the geopolitical risk premium fades, we may well end up in a situation where Fiji’s overall inflation in 2025 – that is the average price increase across all of the CPI items – is less than the 1% prediction contained in the Budget papers.

According to him, the budget repair task remains over the medium to longer term.

Sen says Fiji’s successive deficit budgets have added to the stock of debt.

With respect to the government’s ability to finance its deficit for 2025-26, roll over maturing debt, and to be able to afford the stock of debt, Sen states that he doesn’t see any problems with that because Fiji has a roadmap to continue to grow the economy.

Sen adds he sees optimism in Fiji’s economic prospects, and that comes from the investment that will take place over the next decade or so.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap