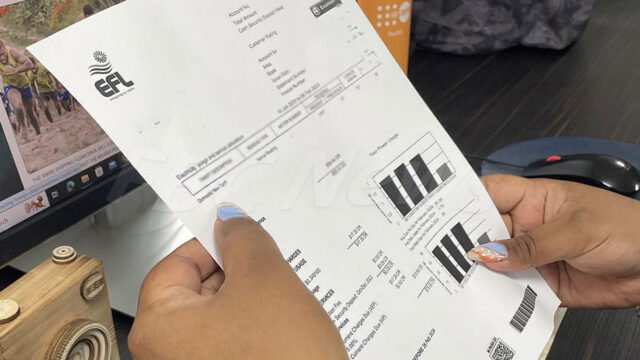

The new fiscal rates, or excise duties, have kicked in following the national budget announcement yesterday.

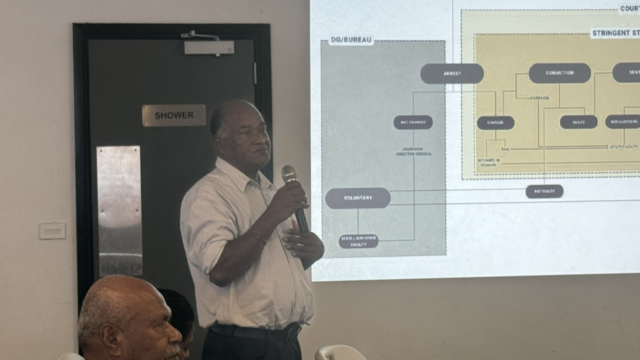

This has been confirmed by Fiji Revenue and Customs Service Chief Executive Mark Dixon while answering a question during the post-budget talanoa session hosted by the Fiji Commerce and Employers Federation.

FCEF Chief Executive Kameli Batiweti sought clarifications from the FRCS Chief on whether the new rates will apply to the shipment that set sail prior to the budget announcement but has yet to arrive in the country.

“Will the new excise duties apply to shipments that sailed before the national budget announcement? Generally, new rates apply for any shipment or purchase after the budget announcement.”

FRCS Chief Executive, Mark Dixon says nothing has changed this year as the excise taxes are always implemented following the release of the budget.

“We always lock down the customs system at midnight—the night before the budget—and we did that on Thursday night. All the new rates are loaded into the system through the night. After the Minister’s announcement on time yesterday morning. As soon as the speech was finished, the system went live with the new rates. So the new rates apply to everything coming in post budget at 10 o’clock.”

Dixon says all the customs agents are aware of the changes in the excise duties.

There has been a five percent increase in the alcohol and tobacco excise duties, while the excise on sugar-sweetened beverages will be increased from 35 cents per litre to 40 cents per litre. Motor vehicle import excise duty will increase on all new and used passenger vehicles by an additional five percent.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Kreetika Kumar

Kreetika Kumar