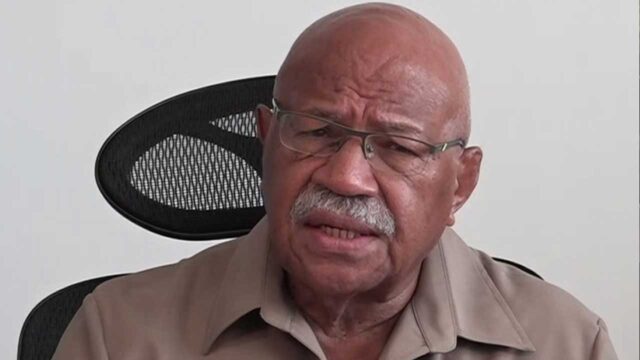

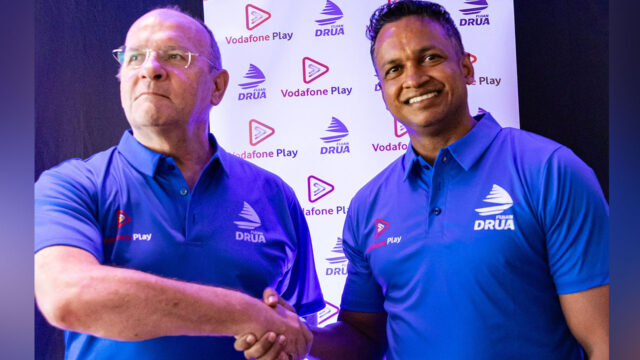

SOLE Founder Semi Tukana has shed light on the increasing fascination with budgeting and investment culture among individuals.

Speaking at the launch event of SOLE yesterday, a homegrown social financial platform, Tukana emphasized the pressing need to address the ongoing struggle with effective money-saving and prudent expenditure, especially among the younger generation.

He says with innovative SOLE concept, their primary objective is to empower individuals with enhanced fund management skills.

Tukana says the financial concept is gaining momentum, particularly in rural areas, marking a significant shift in the traditional financial landscape.

“We understand the plight of our people, the financial burden they carry, and their lack of financial savvy. When we presented SOLE to the people of the villages and rural areas, their eyes glowed with excitement, and they felt emotional because they knew that this financial tool could help them out of their financial burden.”

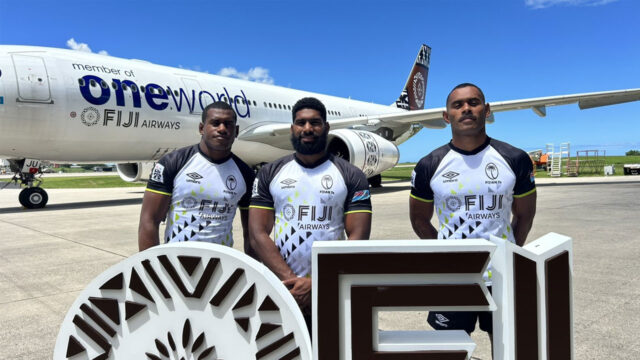

Within a year, SOLE has garnered an impressive customer base exceeding 12,000 users, facilitating transactions surpassing a million dollars in total value.

SOLE Chief Executive Mereia Volavola highlighted a distinctive feature of the app – a ‘bucket list’ option.

“We are not only going to change the financial landscape here in Fiji; equally so, we want to free the people in how they handle finance.”

The SOLE app is poised for further expansion, with a recent stride into shopping payments.

It is now operational at a local supermarket, with plans to integrate into other retail outlets in the coming months.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Shania Shayal Prasad

Shania Shayal Prasad