The deadline for tax compliance has passed. Tax evaders are now at risk of prosecution.

The Fiji Revenue and Customs Service stated that it spent months educating taxpayers and urging honest filing.

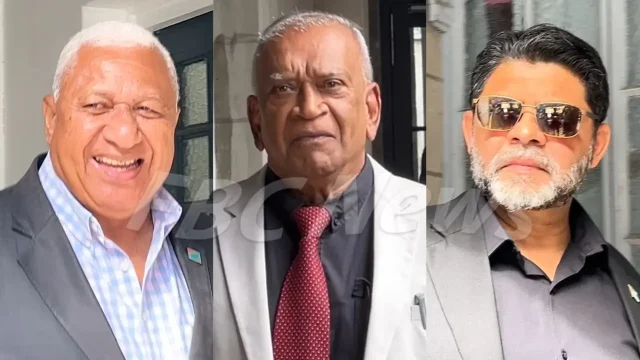

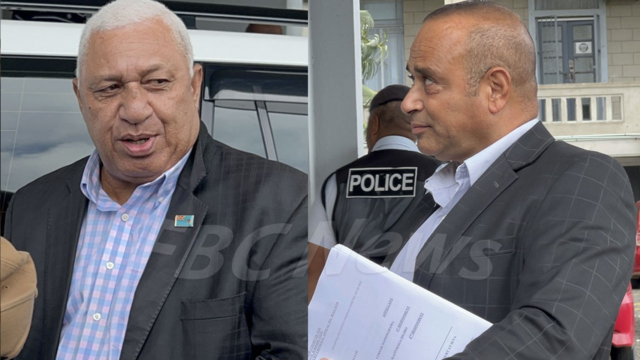

Tax Crimes Task Force Chair Nitin Gandhi said the Fiji Independent Commission Against Corruption was already handling several cases, signalling a tougher national stance on tax evasion.

“And if you notice the messaging that’s been happening over the last 12 months, and with the digitisation platform, we want to make sure that taxpayers are compliant. When we say compliant, we mean let’s be honest and pay legitimate taxes, but some take advantage of the system and do not comply. And with tax evasion, tax evasion is illegal, and if we have evidence of that, then we’ll deal with it.”

The Task Force has publicly shared information on major cases and emerging patterns to boost transparency and raise awareness about compliance.

Fiji Financial Intelligence Unit Director Caroline Pickering states the task force improves efficiency by forcing agencies to share intelligence, detect evaders and take action.

“Tax crimes leads to money laundering. When people, when entities evade tax, the result is there is more laundering of proceeds in the financial system, so they are able to profit from that illegal activity. So only by sharing financial intelligence, we are able to trace where this undeclared income are kept, where they are transacted, where they are invested, so that we can take necessary actions as law enforcement agency, as a tax authority.”

The task force, led by FRCS is expanding its database with technical support from Australia and New Zealand revenue authorities to better track trends and identify taxpayers who evade their obligations.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Nikhil Aiyush Kumar

Nikhil Aiyush Kumar