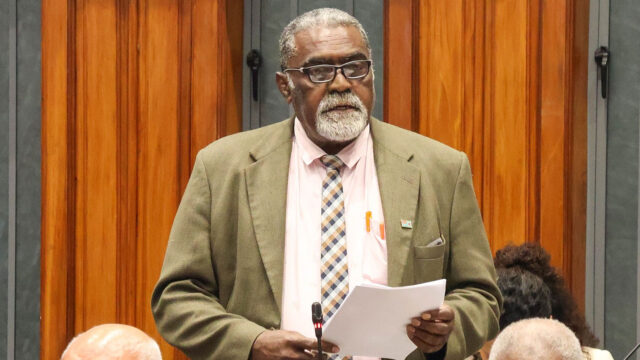

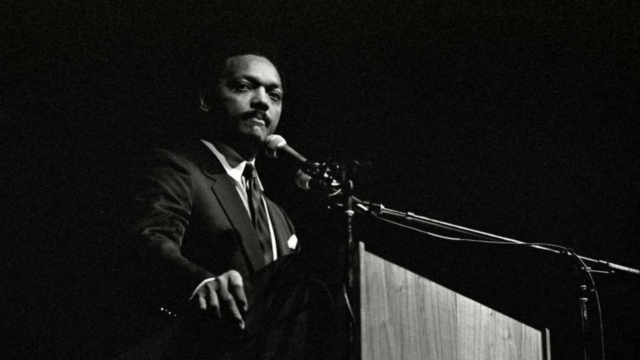

CEO Mark Dixon.

The Fiji Revenue and Customs Service launched its 2023-2025 Compliance Improvement Strategy today.

This two-year strategy is designed to enhance voluntary compliance and improve tax system’s effectiveness.

FRCS have identified certain compliance risk areas that they will work on.

CEO Mark Dixon says the new strategy by the Fiji Revenue and Customs Service’s is expected to boost customer confidence in the self-assessment and voluntary compliance tax environment.

“A tax administration should strive towards having very robust strategies and policies structures in place to ensure that non-compliance with the tax law is kept to a minimum.”

Dixon says there needs to be recognition of the importance of paying a fair and equitable amount of tax to encourage a change in approach to tax payment.

“As being important to everyone in this room but actually everybody in the Fijian economy, it’s a civic and national duty that we do that.”

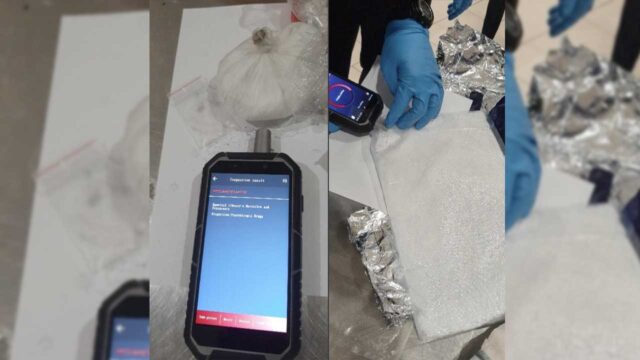

FRCS’s Manager Risk Assessment & Financial Intelligence Corporate Services Rohitesh Dass says creating a conducive environment for all economic players will be vital.

“Through this strategy we aim to improve voluntary compliance, reduce the cost of compliance in key risk areas and ultimately increase revenue.”

Under this strategy, the identified risky areas will be assessed, and corresponding strategies will be recommended for implementation.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Kirisitiana Uluwai

Kirisitiana Uluwai