A comprehensive tax reform strategy is needed in the forthcoming budget to raise revenue, simplify the tax system, and enhance efficiency.

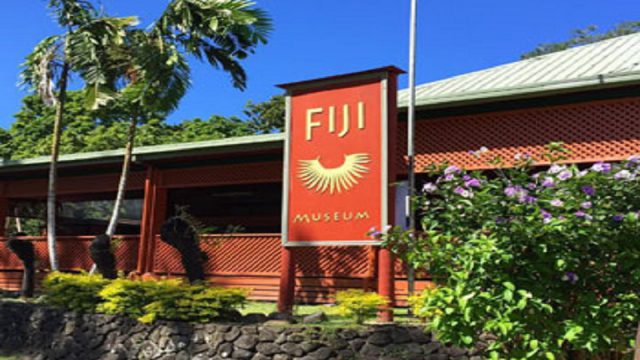

This has been recommended by the IMF team in conclusion to their 2023 Article IV mission to Fiji.

The team says the suggested measures include unifying the VAT rate at a slightly higher level, simplifying personal and corporate income taxes, especially by reducing tax exemptions, and raising certain excise and tourism-specific taxes.

It says that while tax reforms are necessary to raise revenue, they should be accompanied by targeted transfers to low-income households and growth-enhancing measures.

This includes cutting red tape, spending should be disciplined and gradually reoriented to boost growth, enhance resilience, and promote inclusion.

Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members to collect economic and financial information and discuss the country’s economic developments and policies.

Shania Shayal Prasad

Shania Shayal Prasad