Recovering money lost to scams remains one of the toughest challenges for law enforcement.

Police warn that once funds are transferred, they are almost impossible to trace or recover.

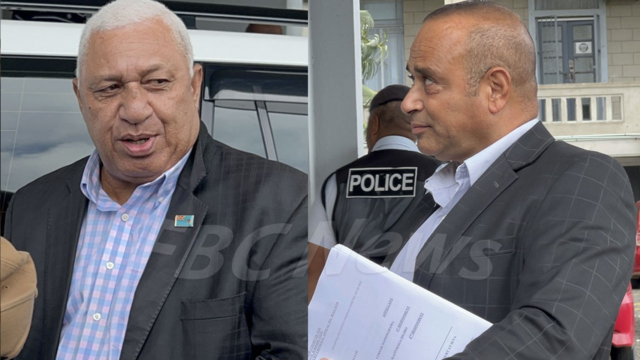

Director of the Criminal Investigations Department SSP Loraini Seru states police can investigate scam cases but are not empowered to return stolen money.

She explained that scammers move quickly, using fake identities, multiple numbers and unregistered SIM cards to hide their digital footprints.

“That is one issue that we have always been battled with and which does not only challenge us as investigators because of the limitations we have in relation to the legal framework that we currently have but more so on the fact that we are also restricted, that we only confine ourselves to the criminal offence that we are investigating.”

SSP Seru said the CID Cybercrime Unit and Digital Forensics Team operate 24/7 under the Budapest Convention with the Office of the Director of Public Prosecutions to track cross-border crimes.

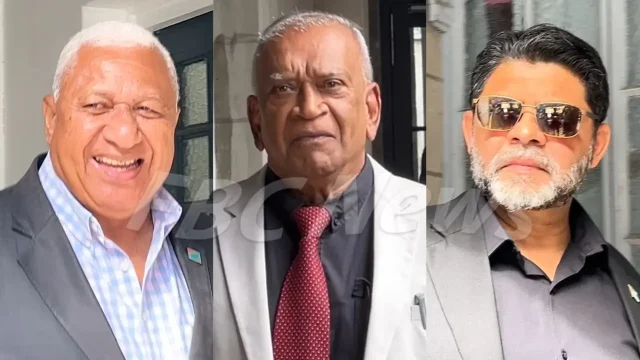

Vodafone’s Head of eCommerce and Digital Financial Services Shailendra Prasad states refunding mistaken M-PAiSA transfers is not straightforward as doing so could breach customer rights and expose the company to legal risk.

“If the court gives us an order to roll back the money then only we can do it. Otherwise, we can’t because if we roll back the money, the grass cutter will come and say Vodafone, you pay me because you had no right to refund.”

He urged users to transfer money only to trusted individuals and avoid social media transactions with unknown sellers, warning that many online scams involve fake advertisements and stolen images of goods from legitimate businesses.

Prasad is reminding Fijians to stop, think and verify before sending money to anyone online.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava