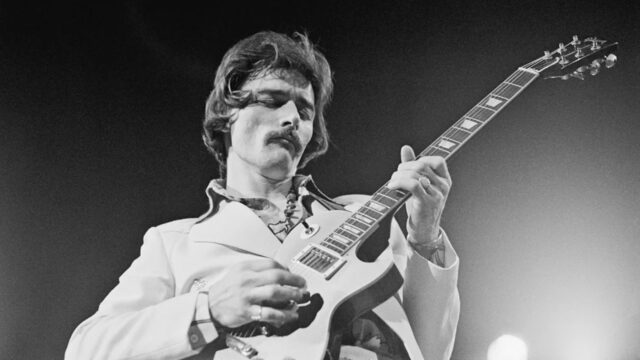

FRCS Chief Executive Visvanath Dass [right]

The Fiji Revenue and Customs Service has recently noted that some businesses are tweaking their IT systems to suppress sales – a deliberate act by non-compliant taxpayers.

FRCS Chief Executive, Visvanath Das says a current major case has cost Fiji millions of dollars in royalty income.

With Fiji tightening up its tax laws, Das says some businesses continue to explore ways to deliberately evade paying taxes but the Fiji Revenue and Customs Service isn’t blind to this.

“The new trend that I am seeing is that some of the discovery we’ve had whereby some companies whereby again I would say these are deliberate non-compliant tax evades. They have sort of resorted to tweaking their IT systems in order to suppress sales and you can see that’s why the government initiative, the VAT monitoring system that it’s actually to address the sale suppression that leads to tax and revenue leakages.”

Das says they’re working on a case involving a multinational business that has been able to evade taxes through book transactions, causing Fiji to lose out on gross royalty income.

“Earlier on I had made mention of how one company has conducted book-entry transactions and gotten a $74m worth of transaction which left Fiji losing the IP right to Singapore. When in fact this could have gotten us a royalty income but now the situation is that we’re only going to get royalty taxes on gross royalty income. There’s a name and shame law in place and we could do that but I would not want to jeopardize the case as of now. But again I would probably say looking at the quantum involved and the transaction value it’s easy to figure out that it has to be a multi-national company.”

Das says the implementation of the VAT monitoring system will ensure businesses engage in transparent dealings and will hold retailers accountable for non-compliance.

Koroi Tadulala

Koroi Tadulala