The Revenue and Customs Service has clarified how they will assess businesses, particularly new ventures.

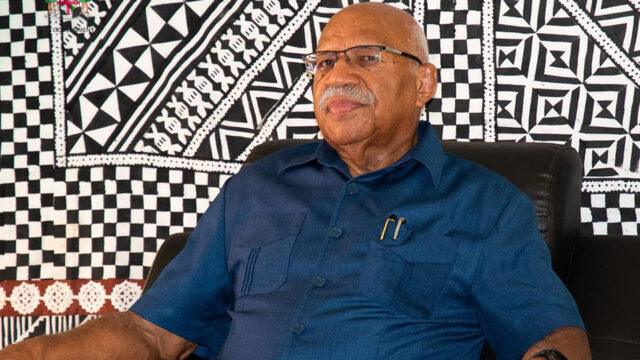

In a submission before the Parliamentary Standing Committee on Public Accounts, FRCS chief executive officer, Visvanath Das says there are processes in place to ensure that businesses are paying what is owed and are compliant with the relevant tax laws.

“A new company making the first Vat return claim, the first refund will become subject to an audit inspection, site visitation, we need to know what’s happening on the ground? Is it happening on the ground or not before we can do a refund. Also then the process has provisional approval, final approval, then again you have an audit. We’ve got to justify the total investment is such and such, you know so many years of concession can be given or tax holiday can be given, so there is audit processes in place.”

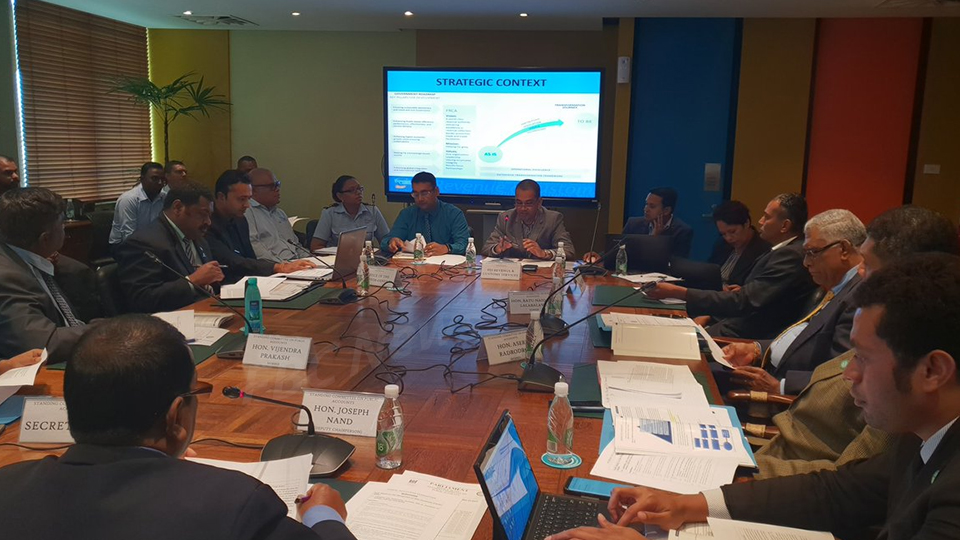

Das and his FRCS executive team held a three-hour submission session this afternoon with the Public Accounts Committee.

#Fiji #PAC in session, submission from the #FRCS on audit.. More tonight @FBC_News from 7pm pic.twitter.com/Am7YpQpZez

— MaggieFBCNews (@MaggieFBCNews) March 28, 2019

They thoroughly discussed several issues highlighted in the 2016/2017 Audit report on the management of the duty concession scheme.

Maggie Boyle

Maggie Boyle