Following the high fines paid by certain supermarkets in tax fraud, the Fiji Revenue and Customs Service has expanded its investigations into other sectors.

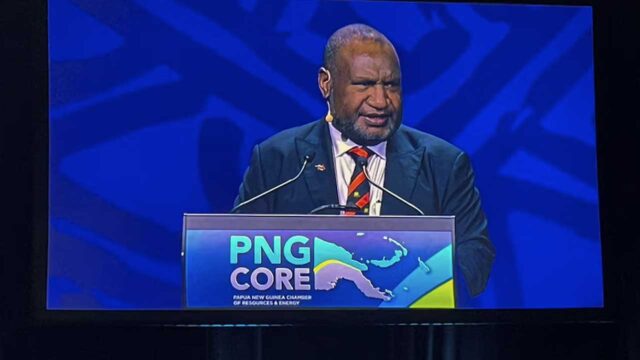

Speaking to FBC News, Chief executive, Visvanath Das says the Revenue and Customs have conducted investigations in the Customs evaluation space including the construction, real estate and supermarket sector.

Das says it’s rather unfortunate that certain taxpayers would opt to cheat the system, however, he adds the Revenue and Customs have stringent mechanisms in place to monitor tax evasion.

“I just want to assure them that we have robust systems in place, we have our full audit investigation teams, we have our desk audit teams, we have ever layer of checking that we do to ensure the correct funds are being processed.”

Das says as the Revenue and Customs moves into the next financial year, they

will be conducting corporate planning workshop to determine compliance in these sectors.

He adds following the workshops other sector will be identified for tax evasion investigation.

Meanwhile, the three prominent supermarkets, including one based in Nasinu paid a fine of more than twenty million dollars for tax fraud.

Months after a supermarket had to fork out over fifty million dollars in unpaid taxes, this latest find has sent out worrying a signal to the tax office.

Das says the Revenue and Customs is coming down hard on supermarkets as five supermarkets have been investigated so far this financial year.