Credit Unions in the Pacific play a vital role in not only assisting the poor but also contributing to the economic growth of the microfinance sector.

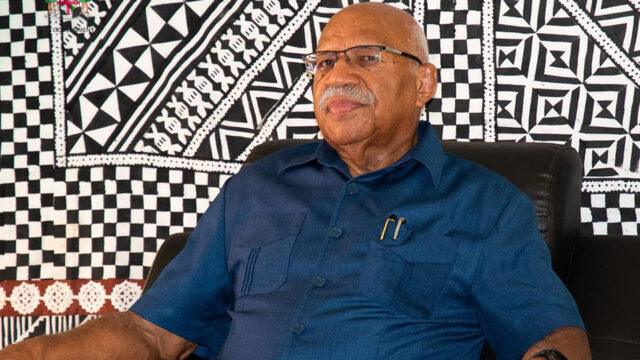

Speaking at the Oceania Confederation of Credit Union Leagues (OCCUL) – Tonga League Board Chair Mele Amaraki says the organisation tremendously helps low income earning families.

“Credit Unions offer members from all walks of life especially the poor a life that has the ability to not only to access financial services but also provides members a chance to own their own financial institutions and to help them create opportunities such as starting small businesses, growing farms, building family homes and educating their children.”

Participants will share information, data and progress of local and regional credit unions with discussions on-going about how to improve services to their 19 member countries.

Amaraki says she is pleased that more developed member countries like Fiji are positively contributing to the net worth of the organisation.

“The net worth of the credit union valued at around $250m with a major portion of that being from Fiji and Papua New Guinea. It is tough fighting economies of small scale and like any other business the credit union movement in the Pacific faces enormous challenges in the current market places against commercial banks and other larger facilities.”

Amaraki says the biggest of these challenges relate to regulating issues and the technical ability to keep accurate records.