Fiji has lost almost $4 billion in foreign reserves in the last two years.

This was highlighted by Governor of the Reserve Bank of Fiji, Arif Ali at the Top Executive (TOPEX) Conference at the Sofitel Resort in Nadi.

However, the Governor says due to the strong levels of reserves, there was no need to move in the direction of devaluing the Fiji dollar.

Ali says the pandemic has been the worst ever crisis as it brought not only Fiji’s economy to its knees but the economies of many other countries as well.

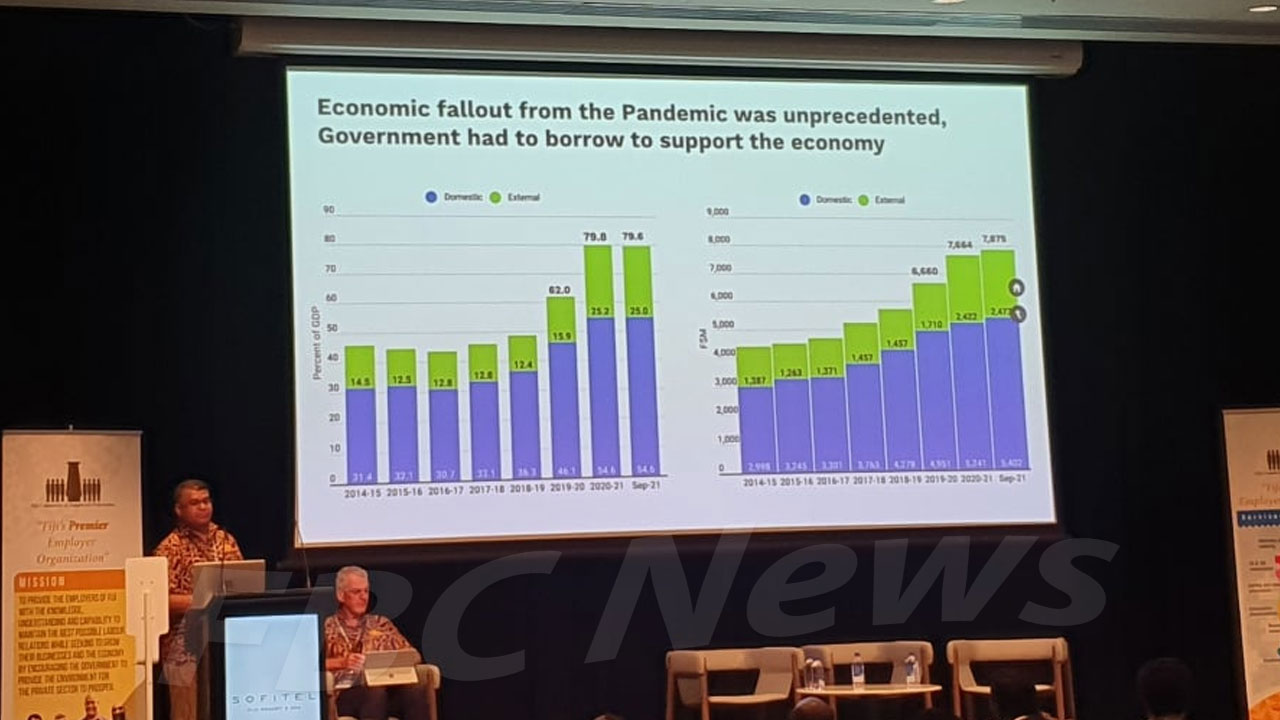

“You know Government borrowed more, Government’s revenue declined sharply and they maintained a similar expenditure, Government’s deficit was much larger. In the 2019-2020 financial year they borrowed about an additional $600 million, last financial year $1 billion that was slightly less than what was budgeted because of the additional revenue they received from the divestment of EFL as well as the grants they received otherwise it would have been slightly more.”

He says as a result of this, Government debt which was 50% of Gross Domestic Product four years ago has increased to almost 80%.

The Governor adds a large percentage of this deficit in the last two years was financed from offshore.

“And the reason why Government financed this offshore is because of two reasons, one the domestic market does not have the capacity for Government to borrow anything around $500-$600 million, the key lenders are FNPF, the insurance companies and a few institutional investors, so Government was forced to borrow and two, the interest rate prevailing in the global market is much lower than domestically.”

Some of these loans are for 25 years with a grace period of 10 years.

He also highlighted that unpaid loans from businesses or private individuals accumulated to $2.6 billion but this has decreased significantly as things are opening up.

During this period, the RBF assisted close to 5,000 businesses with a large portion being small-medium enterprises (SMEs).

Ali says over the last 18 months, the Central Bank injected in excess of half a billion dollars through the natural disaster recovery facility and through SMEs.

Filipe Naikaso

Filipe Naikaso