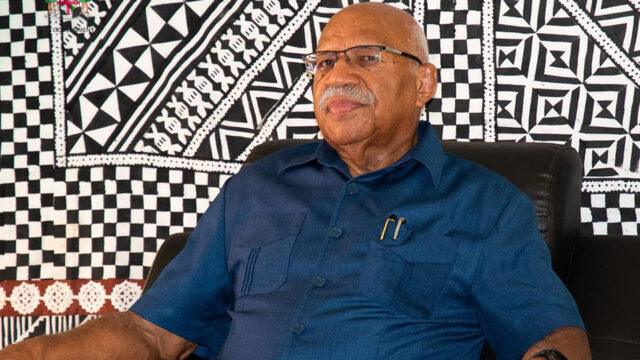

The Reserve Bank Governor says the trickle-down effect of the reduction in lending rates under their facilities is likely to see businesses and household save approximately $3.5m annually.

RBF Governor, Ariff Ali says influencing the direction of interest rate is a way of supporting our economy during this COVID-19 situation.

Ali says the role of any central bank is to support the economy by ensuring that there is price stability and adequate foreign reserve.

“For some businesses, this could be the difference to surviving or closing down. For some it could mean hiring more staff. Overall, when businesses operate in a lower interest environment it should translate to more economic activity, more employment and more purchases for government.”

The RBF Governor is calling on Banks to ensure the reduction is passed on to Fijians.

“As this lending institution facilities are accessible to institutions that the RBF supervises or regulate, I expect interest rate on all the loans under the facility to fall below 3.99 percent”.

This move by RBF will assist thousands of Fijians struggling to make ends meet during this second wave of COVID-19 pandemic.

Koroi Tadulala

Koroi Tadulala